reverse sales tax calculator california

Divide tax percentage by 100 to get tax rate as a decimal. The California state sales tax rate is 725.

Calculate The Sales Taxes In The Usa For 2022 Credit Finance

Here is how the total is calculated before sales tax.

. Use the 540 2EZ Tax Tables on the Tax Calculator Tables and Rates page. 5 digit Zip Code is required. Reverse Sales Tax Computation Formula.

Required Field California taxable income Enter line 19 of 2021 Form 540 or Form 540NR Caution. Please ensure the address information you input is the address you intended. Home Top Free Apps.

Divide 1100 by 11 and you get 1000. That entry would. PRETAX PRICE POSTTAX PRICE 1 TAX RATE Common Mistakes.

Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase. See the article. If your total receipt amount was 5798 and you paid 107 percent in sales tax youd simply plug those numbers into our calculator to find out that your original price before tax was 5737.

Start filing your tax return now. Formulas to Calculate Reverse Sales Tax. Denotes required field Calculate.

Property Information Property State. Divide your sales receipts by 1 plus the sales tax percentage. Amount without sales tax GST rate GST amount.

Pre Tax Price of Product Sale Price Post Tax Price 1 TAX RATE Have you checked California sales calculator. On March 23 2017 the Saskatchewan PST as raised from 5 to 6. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

Multiply the price of your item or service by the tax rate. Welcome to the TransferExcise Tax Calculator. This tool can calculate the transferexcise taxes for a sale or reverse the calculation to estimate the sales price.

Find list price and tax percentage. Not all products are taxed at the same rate or even taxed at all in a given. Do not use the calculator for 540 2EZ or prior tax years.

Depending on local sales tax jurisdictions the. If you have tax rate as a percentage divide that number by 100 to get tax rate as a decimal. Try our FREE income tax calculator.

From there it is a simple subtraction problem to figure out that you paid 61 cents in sales tax. For instance in Palm Springs California the total sales tax percentage including state county and local taxes is 7 and 34 percent. Enter the sales tax percentage.

California sales tax details. Tax can be a state sales tax use tax and a local sales tax. The tax rate given here will reflect the current rate of tax for the address that you enter.

Our free online California sales tax calculator calculates exact sales tax by state county city or ZIP code. Calculate net price and sales tax amounts. Calculate your 2021 tax.

Tax calculator is for 2021 tax year only. The only thing to remember in our Reverse Sales. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax.

Tax rate for all canadian remain the same as in 2017. For example suppose your sales receipts are 1100 and the tax is 10 percent. How to Calculate Sales Tax.

Current HST GST and PST rates table of 2022. Multiply the result by the tax rate and you get the total sales-tax dollars. Often knowing the post-tax price in one municipality will provide little information of value to a person who is not subject to the same tax structures.

This Sales Tax Calculator And De-Calculator will calculate sales tax from an amount and tax or reverse calculate with the tax paid. Do not include dollar signs commas decimal points or negative amount such as -5000. In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax.

Amount without sales tax QST rate QST amount. California has a 6 statewide sales tax rate but also has 474 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 2617 on top. 52 rows This reverse sales tax calculator will calculate your pre-tax price or amount for you.

A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Thus you can compute the actual price and the sales tax charged on it out of a products post-tax priceThe formula for computing the actual sales price is easy. This rate is made up of a base rate of 6 plus California adds a mandatory local rate of 125 that goes directly to city and county tax officials.

Subtract that from the receipts to get your non-tax sales revenue. Sales tax calculator to reverse calculate the sales tax paid and the price paid before taxes. Then use this number in the multiplication process.

Type an address above and click Search to find the sales and use tax rate for that location. TAX DAY NOW MAY 17th - There are -378 days left until taxes are due. This calculator does not figure tax for Form 540 2EZ.

Quickly figure your 2021 tax by entering your filing status and income.

How To Calculate Sales Tax In Excel Tutorial Youtube

Sales Tax Reverse Calculator Internal Revenue Code Simplified

California Sales Tax Calculator Reverse Sales Dremployee

Us Sales Tax Calculator Reverse Sales Dremployee

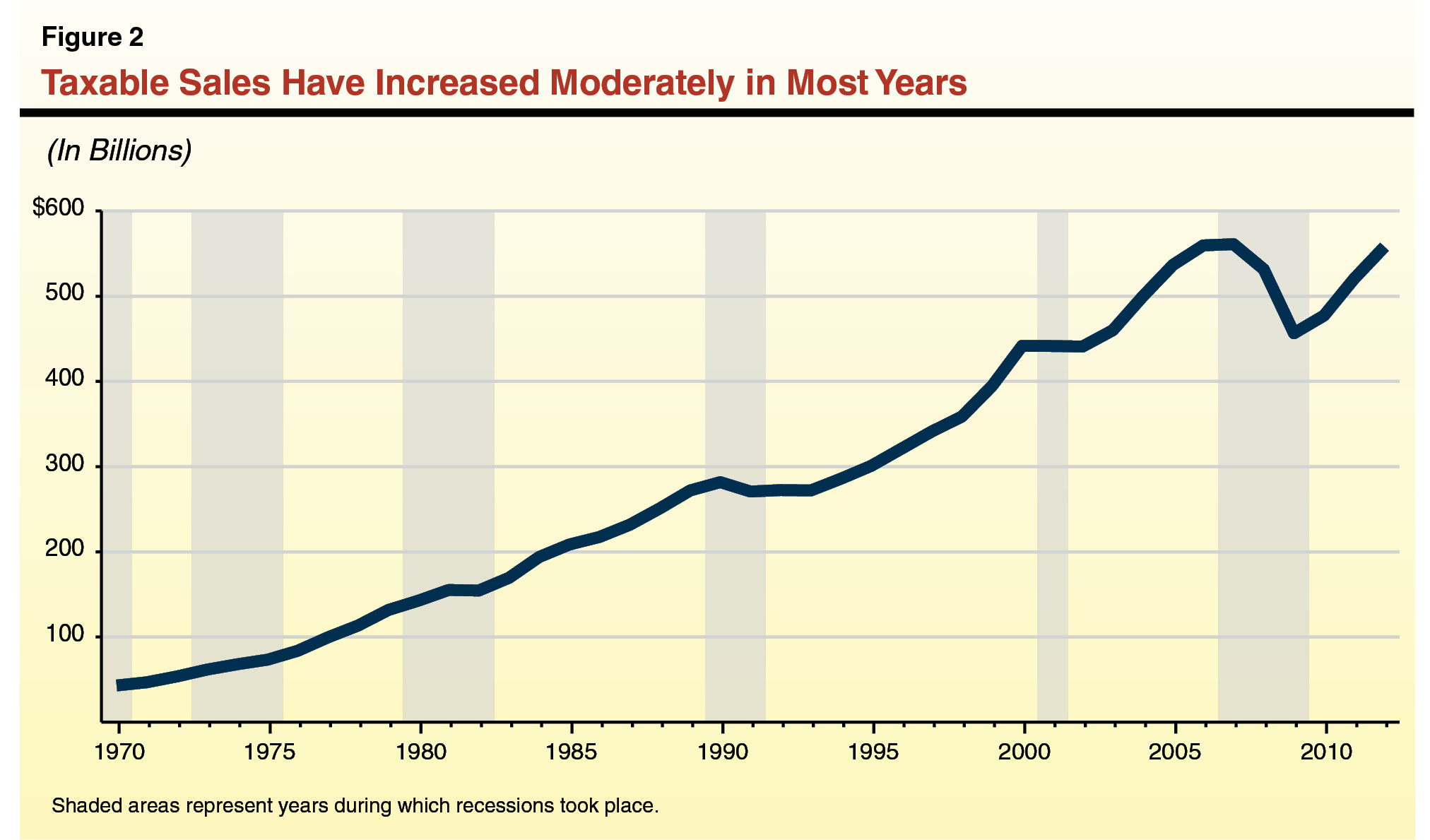

Why Have Sales Taxes Grown Slower Than The Economy

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

California Sales Tax Calculator Reverse Sales Dremployee

Reverse Sales Tax Calculator Calculator Academy

Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System

Reverse Sales Tax Calculator De Calculator Accounting Portal

Best Practices For Sales Tax Display In The Checkout

Reverse Sales Tax Calculator Calculator Academy

California Can T Mimic No Income Tax Texas Without Substantial Spending Reforms

Reverse Sales Tax Calculator Calculator Academy

How To Pay Sales Tax For Small Business 6 Step Guide Chart

Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System

Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System